On Friday, June 20, 2023, the Centers for Medicare & Medicaid Services (“CMS”) posted a pre-publication copy of the Calendar Year (“CY”) 2024 Home Health Prospective Payment System Rate Update (“PPS Rule”), which has since been published in the Federal Register and is currently open for comment. The PPS Rule usually only impacts the home health industry, but this year CMS has included proposals related to not only home health, but also hospice, DMEPOS and provider enrollment. There are a number of reasons for the breadth of this rule, including CMS’s need to implement statutory changes. CMS, as it did last year, is utilizing the PPS Rule rulemaking as an opportunity to address these changes.

Annual Home Health Payment Update

For home health providers, the Annual Payment Update is the most anticipated and disappointing aspect of the PPS Rule. The projected CY 2024 annual payment update percentage is 3.0%. That number will disappoint providers. Inflation for 2022 was measured at 6.5% for the year, with a peak of 9.1% in June 2022. A 3.0% increase is insufficient to allow reimbursement to keep up with inflation and other financial pressures the industry is facing. However, agencies will not see a 3.0% increase. The market basket increase must be adjusted for productivity and budget neutrality.

| CY 2023 National Standardized 30-Day Period Payment | Permanent BA Adjustment | Case-Mix Weights Recalibration Budget Neutrality | Wage Index Budget Neutrality | Labor-Related Share Budget Neutrality | CY 2024 HH Payment Update | CY 2024 National, Standardized 30-Day Period Payment |

| $2,010.69 | 0.94347 | 1.0121 | 1.0015 | 0.9998 | 1.027 | $1,974.38 |

This calculation includes an adjustment for behavioral changes in response to Patient Driven Groupings Model (“PDGM”), discussed below. Applying the required adjustments results in a CY 2024 payment that is 1.81% less than the CY 2023 payment, despite the 3.0% payment update. Agencies that fail to submit their quality data will have an additional 2% deducted from their reimbursement.

| CY 2023 National Standardized 30-Day Period Payment | Permanent BA Adjustment | Case-Mix Weights Recalibration Budget Neutrality | Wage Index Budget Neutrality | Labor-Related Share Budget Neutrality | CY 2024 HH Payment Update | CY 2024 National, Standardized 30-Day Period Payment |

| $2,010.69 | 0.94347 | 1.0121 | 1.0015 | 0.9998 | 1.007 | $1,935.93 |

These are only the proposed rates. Every year the rates in the final rule change slightly as CMS utilizes more current data, but agencies need to begin planning for yet another rate reduction in 2024. CMS anticipates this proposed change will result in a $375 Million reduction in home health spending in 2024.

PDGM Behavioral Adjustments

The proposal to reduce home health reimbursement flows directly from Patient Driven Grouping Model (“PDGM”). Under PDGM, CMS must “annually determine the impact of differences between assumed behavior changes … and actual behavior changes on estimated aggregate expenditures” every year from 2020 to 2026. CMS can make temporary or permanent changes to the prospective payment to adjust for the identified impact of behavioral change. CMS implemented a -4.36% adjustment at the beginning of PDGM in anticipation of projected behavioral change under PDGM. Last year, CMS initially proposed a 7.85% cut to home health reimbursement as a result of “behavioral changes” but only implemented a 3.925% cut. CMS warned that future cuts would be necessary.

CMS reviews multiple data points to assess both the impact of PDGM on home health spending and the “behavioral changes” that resulted from PDGM. CMS first reviews home health utilization.

Table B1: Overall Utilization of Home Health Services, CYs 2018-2022

| Volume of Periods and Number of Beneficiaries | CY 2018 (Simulated) | CY 2019 (Simulated) | CY 2020 | CY 2021 | CY 2022 |

| 30-Day Periods of Care | 9,336,898 | 8,744,171 | 8,423,688 | 8,962,690 | 8,386,706 |

| Unique Beneficiaries | 2,980,385 | 2,802,560 | 2,850,916 | 2,944,305 | 2,781,575 |

| Average Number of 30-Day Periods per Unique Beneficiary | 3.13 | 3.12 | 2.95 | 3.04 | 3.02 |

Although the number of episodes per beneficiary is holding at approximately three, CMS is concerned that the number of visits per episode is declining.

Table B2: Utilization of Visits per 30-day Periods of Care by Home Health Discipline, CYs 2018-2022

| Discipline | CY 2018 (Simulated) | CY 2019 (Simulated) | CY 2020 | CY 2021 | CY 2022 |

| Skilled Nursing | 4.53 | 4.49 | 4.35 | 4.05 | 3.89 |

| Physical Therapy | 3.30 | 3.33 | 2.70 | 2.74 | 2.77 |

| Occupational Therapy | 1.02 | 1.07 | 0.79 | 0.78 | 0.77 |

| Speech Therapy | 0.21 | 0.21 | 0.16 | 0.15 | 0.14 |

| Home Health Aide | 0.72 | 0.67 | 0.54 | 0.48 | 0.43 |

| Social Worker | 0.08 | 0.08 | 0.06 | 0.05 | 0.05 |

| Total (all disciplines) | 9.86 | 9.85 | 8.59 | 8.25 | 8.05 |

According to this data, the total number of visits per episode has declined by almost two. However, the total number of episodes that qualify for a Low Utilization Payment Adjustment (“LUPA”) is 7.8%, which is down only slightly from last year’s 7.9%, although it is still 1% higher than CY 2019.

CMS then addresses home health reimbursement in comparison to home health costs. After analyzing cost report data, CMS concludes that the CY 2022 National Standardized Episodic Payment paid home health agencies 45% more than their costs. CMS attributes this to a decline in costs due to a reduction in visits. Unfortunately, the home health cost report data does not appear to reflect the reality of inflation and wage pressures in health care. CMS’s conclusion that home health reimbursement outstrips home health costs by 45% means that CMS does not see any concern with ongoing reductions in home health reimbursement.

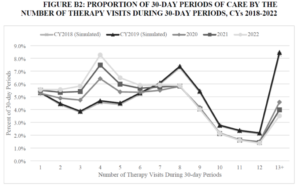

PDGM Therapy Utilization

CMS also assesses the impact of PDGM on therapy utilization. As you may recall from discussions of PDGM in the years prior to 2020, there was a great deal of concern that the elimination of the therapy bonus payment system would result in significant reduction, perhaps even an elimination, of therapy utilization in home health. The feared elimination of therapy in home health did not materialize, but CMS has noted changes in therapy utilization patterns.

The number of home health episodes that involve six or fewer therapy visits has actually increased since PDGM. However, the number of episodes with seven or more therapy visits has declined. Overall, the total number of therapy visits has declined. CMS states later in the proposed rule that “HHAs changed their behavior to reduce therapy visits.” The fact that episodes with eight or more therapy visits have declined should not surprise CMS as much as it does. It was inevitable. Steadily declining home health reimbursement, wage/cost increases for therapists and the elimination of the therapy threshold payments have made it difficult for home health providers to afford to provide 12 or more therapy visits per episode. There have also been developments in therapy care arising out of Medicare’s other cost saving initiatives, such as Medicare’s bundled payment initiative and ACOs, which led to therapy care with fewer visits while maintaining outcomes. CMS has reduced reimbursement repeatedly over the years but then is surprised to discover that these cuts have a practical impact.

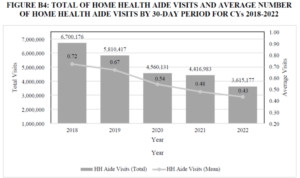

Home Health Aide Utilization

CMS identifies an even more surprising development in home health utilization – a decline in utilization of home health aides.

In response to this significant decline in home health aide utilization, CMS is requesting information regarding access to home health aide services. The industry should respond to this request in order to address the difficulties in hiring home health aides and CMS’s questions related to aide compensation.

CMS states it “has heard that beneficiaries have had difficulty receiving home health aide visits under the Medicare home health benefit. Additionally, our monitoring has shown that home health aide visits have decreased…CMS wants to ensure that all Medicare beneficiaries receiving care under the home health benefit are afforded all covered services for which they qualify.” There have been reports that some agencies decline to provide home health aide services. CMS may be warning Medicare home health providers that declining to provide home health aides services is improper. This will be an area to monitor.

Calculating Impact of the Behavioral Changes

Having reviewed behavioral changes, CMS then seeks to determine the fiscal impact of these behavioral changes. CMS utilizes the methodology it finalized last year in the Home Health PPS rule to assess the impact of behavioral change on home health expenditures. This methodology seeks to determine what the aggregate home health expenditure would have been under the old PPS model to determine if PDGM has resulted in an increase or decrease in expenditures. After performing their analysis, CMS concluded that under PDGM, CMS’s aggregate expenditures for home health care increased by 9.36% due to differences between home health providers’ assumed behavior and actual behavior. This number has to be adjusted to account for last year’s 3.925% permanent adjustment. When this adjustment is made, the result is a -5.653% permanent adjustment to the CY2024 national standardized 30-day payment. CMS acknowledges that a -5.653% adjustment is significant. CMS has concluded it is appropriate to move forward with the full permanent adjustment.

CMS concludes that a $3,439,284,729 temporary adjustment is also required to offset the amounts by which home health expenditures under PDGM exceeded what they would have been prior to PDGM. CMS realizes that “the magnitude of both the temporary and permanent adjustments for CY 2024 rate setting may result in a significant reduction of the payment rate.” CMS is foregoing implementing the temporary adjustment in CY 2024 but will address this in a future rulemaking. This temporary adjustment will continue to loom on the horizon. With each passing year, the size of the temporary adjustment required will continue to grow. This could lead to a significant temporary reduction to reimbursement in future rulemaking.

On July 5, 2023, the National Association for Home Care and Hospice filed a lawsuit in federal court challenging CMS’s efforts to account for “behavioral change.” NAHC’s lawsuit was filed after CMS refused to acknowledge that its efforts to correct for “behavioral change” did not conform to the statutory requirements or, as NAHC describes it, “is contrary to the requirements of reasoned decision-making.” This lawsuit may lead to changes in these arbitrary behavioral assumptions.

LUPA Thresholds and Case Mix Weights

CMS proposes to revise the Low Utilization Payment Adjustment (“LUPA”) thresholds and case mix weights based upon CY 2022 home health claims linked to OASIS assessment data. The proposed rule lists the revised LUPA Thresholds and case mix weights on Table B22 in the proposed rule. Providers should review these proposed changes and assess their impact on the provider. This is especially important for the LUPA changes. Providers need to be aware of any Home Health Resource Group (“HHRGs”) where the LUPA threshold will increase for 2024.

Home Health Value-Based Purchasing

We are now into the first performance year for Home Health Value-Based Purchasing (“HHVBP”). Not surprisingly, CMS proposes to make several changes to HHVBP.

CMS proposes to formally promulgate regulations to codify the eight factors that govern the removal of measures from HHVBP that it originally outlined in the CY 2022 HH PPS Final Rule.

CMS also proposes to remove the following five measures from HHVBP: “(1) OASIS-based Discharged to Community (DTC); (2) OASIS-based Total Normalized Composite Change in Self-Care (TNC Self-Care); (3) OASIS-based Total Normalized Composite Change in Mobility (TNC Mobility); (4) claims-based Acute Care Hospitalization During the First 60 Days of Home Health Use (ACH); and 5) claims-based Emergency Department Use without Hospitalization During the First 60 Days of Home Health (ED Use).”

CMS proposes to replace those five measures with the following three measures: “1) the claims-based Discharge to Community-Post Acute Care (“DTC-PAC”) Measure for Home Health Agencies; 2) the OASIS-based Discharge Function Score (“DC Function”) measure; and 3) the claims-based Home Health Within-Stay Potentially Preventable Hospitalization (“PPH”) measure.” These changes would be effective with the CY 2025 performance year and are intended to bring the expanded HHVBP model into alignment with HHQRP, as well as the measures that are publicly reported on Home Health Compare.

With five measures being replaced by three measures, CMS proposes to reweight the measures. CMS will not change the weights assigned to the HHCAHPS measures, as none of them are changing. The DC Function measure will be given a weight of 20.000 (large cohort)/28.571 (small cohort). The PPH Measure will be given a weight of 26.000 (large cohort)/37.143 (small cohort). The DTC-PAC Measure will be given a weight of 9.000 (large cohort)/12.857 (small cohort). The DC Function and PPH Measures will carry significant weight for a provider’s HHVBP score.

More importantly, CMS proposes to change the baseline year for HHVBP for the second time in two years. Beginning with CY 2025, CMS proposes to make CY 2023 the baseline year. This has significant ramifications for providers, as the baseline year plays a key role in the TPS calculation. CMS considered leaving the baseline at CY 2022 but rejected it because it used “less recent data,” and they felt it made it harder for agencies to track. This raises the possibility that the “baseline year” will move forward in future rulemakings, which undercuts the idea of a baseline. Agencies should carefully consider how the shifting baseline will impact their HHVBP improvement scoring.

CMS also proposes to allow agencies to appeal the result of a reconsideration of the Annual Total Performance Score and Payment Adjustment Report to the Administrator of CMS. An agency that disagrees with the results of the reconsideration will have seven days from the date of CMS’s notification to the agency of the outcome of the reconsideration to request the Administrator of CMS review the results. The Administrator will have the option to decline the request, review and render a final decision, or take no action on the request. The first and last options are practically the same, although the option to decline the request would appear to require formal notice of such a decision. The proposed regulation does not provide any criteria to govern the administrator’s decision.

Although adding a formal appeal to the administrator is a welcome improvement, CMS ought to provide a regulatory framework that controls the Administrator’s decision to decline an appeal or to take no action. Otherwise, the decisions regarding which appeals are, or are not, granted will appear to be arbitrary.

Program Integrity Changes

Although this is the home health rule, it includes broader Medicare program integrity concerns. Two of these changes are hospice-specific and are addressed in a separate article. CMS also proposes to make changes regarding deactivation of billing privileges, requiring fingerprints for revalidating providers who enrolled during the pandemic and expanding the application bar.

Deactivation

Medicare can currently deactivate a provider who has not billed a claim for 12 months. CMS proposes to change this to six months of inactivity. CMS agrees that all billing inactivity raises program integrity issues. CMS understands that there are providers enrolled in Medicare as a requirement for a different payer. In these situations, the provider has no intention of billing Medicare, which leads to prolonged periods of billing inactivity. CMS states that these providers should not expect that the likelihood of a deactivation will increase simply because CMS has shortened this timeframe.

Managing Employees

CMS proposes to expand the definition of managing employees for hospices and SNFs to include hospice administrators or hospice medical directors. With this change, hospices will now need to report both the administrator and medical director as managing employees for their Medicare enrollment. Most hospices were already reporting their administrator but may have not been reporting their medical director.

Previously Waived Fingerprinting

During the COVID-19 Public Health Emergency (“PHE”), CMS waived the requirement that individuals with a 5% or more ownership interest in newly enrolling high-risk providers and suppliers undergo a fingerprint-based background check. CMS is proposing to modify its screening requirements to require that revalidating providers for whom CMS waived the fingerprint background check requirements during their initial enrollment as a result of the PHE would undergo the fingerprint background check as part of their revalidation once the PHE ends. CMS proposes to modify the regulation so that anytime CMS waives the fingerprint background check requirements due to lawful authority, the provider would then undergo the fingerprint check during the revalidation once the emergency ends. This requirement includes home health and hospice going forward. This rule proposes to add hospice to the high-risk category.

Expansion of Reapplication Bar

CMS proposes to expand the prohibition on a prospective supplier or provider reapplying if their application is “denied because the provider or supplier submitted false or misleading information on or with (or omitted information from) its application in order to enroll.” Currently, a provider or supplier denied under these circumstances is barred from enrolling for three years. CMS proposes to extend this to a maximum of 10 years. CMS also proposes to prohibit a provider or supplier subject to this reapplication bar from ordering, referring, certifying or prescribing Medicare-covered services, items or drugs. CMS would enforce this by not paying for any items or “ordered, referred, certified, or prescribed by a provider or supplier that is currently under a reapplication bar.”

CMS also proposes to add a new prohibition on payment. CMS will not pay for “any otherwise covered service, item, or drug that is ordered, referred, certified, or prescribed by a physician or other eligible professional (as that term is defined in section 1848(k)(3)(B) of the Act) who has had a felony conviction within the previous 10 years that CMS determines is detrimental to the best interests of the Medicare program and its beneficiaries.” Unfortunately, CMS does not explain what constitutes a felony conviction that is “detrimental to the best interests of the Medicare program and its beneficiaries.”

Conclusion

CMS proposes significant changes in this year’s proposed rule. The proposed reduction in home health reimbursement is significant in light of both cuts from prior years, inflation and employment competition driving costs. The proposed changes to HHVBP, especially the proposal to move the baseline year, present additional challenges. Shifting the baseline year may impact future performance under HHVBP. CMS’s identification of a decline in home health aide utilization may lead to additional scrutiny due to the potential impact on beneficiaries. Overall, this year’s proposed rule includes changes not just to the home health rules, but hospice surveys and even program integrity efforts.

Practical Takeaways

- Begin assessing the impact of the 1.8% cut for CY2024’s operations.

- Consider how the changes to measures utilized in HHVBP and the shift of the baseline year to 2025 will impact future performance under HHVBP.

- Consider submitting comments to CMS’ RFI regarding home health aide utilization before the comment period closes on August 29, 2023.

- Be aware that CMS is concerned about the decline in home health aide utilization.

If you have questions or would like additional information about this topic, please contact:

- Robert Markette at (317) 977-1454 or rmarkette@hallrender.com;

- Lauren Hulls at (317) 977-1467 or lhulls@hallrender.com; or

- Your primary Hall Render contact.

Hall Render blog posts and articles are intended for informational purposes only. For ethical reasons, Hall Render attorneys cannot—outside of an attorney-client relationship—answer an individual’s questions that may constitute legal advice.