On October 27, 2015, the IRS released final allocation and accounting regulations for tax-exempt bonds (the “New Regulations”). The New Regulations, which can be found here, make three major changes for issuers and borrowers of tax-exempt bonds, in that they: (1) increase flexibility for how qualified equity is allocated to projects financed both with tax-exempt bond proceeds and qualified equity (“mixed-use projects”); (2) limit the amount of private use resulting from use of financed assets by a partnership that includes both for-profit and qualified users (a “public-private partnership”) to the percentage of the partnership attributable to the for-profit partner (i.e., aggregate, rather than entity, treatment); and (3) explicitly allow for anticipatory remedial action (i.e., de-financing assets prior to the incurrence of private business use). Each of these changes is discussed below, as well as some of the practical implications for hospitals and health care systems.

I. Allocation and Accounting

A. Prior Rules

The code limits the private business use of assets financed with tax-exempt bonds1 to a “de minimus” amount (5 percent for 501(c)(3) bonds, inclusive of amounts used to pay costs of issuance). Private business use is: (a) use by other than a qualified user;2 and (b) in the case of 501(c)(3) bonds, use by a 501(c)(3) entity in an unrelated trade or business.

For a variety of reasons, including for the management of private business use, tax-exempt bonds often comprise only a portion of a larger plan of finance, which may include equity or taxable debt. While Treas. Reg. 1.141-6 has long allowed for the allocation of tax-exempt debt and equity pursuant to “any reasonable method,” the dearth of guidance on what methods might be reasonable, combined with the need of bond counsel to provide an unqualified opinion, has caused many bond counsel to require equity be specifically allocated to particular projects with such allocations unchangeable after the final allocation deadline of Treas. Reg. 1.148-6(d)(1)(iii).3

B. Changes

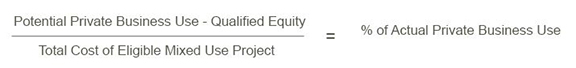

The New Regulations, which apply to bonds issued on or after January 25, 2016 and which may be elected into for bonds issued prior to such date but after May 15, 1997, explicitly provide that any private use will be measured for the entire “eligible mixed use project” and allocated first to “qualified equity.” The result is that only the amount of private business use that exceeds the amount of qualified equity, if any, will be counted against the permitted limits and need to be reported on a borrower’s Schedule K, where applicable. This methodology is sometimes referred to as “floating carveouts” or “floating equity.”

An “eligible mixed use project” is defined as a project financed both with tax-exempt bonds and with “qualified equity,” which is defined to include both equity and taxable debt but not tax-advantaged taxable debt, such as tax credit bonds.

The definition of a “project” is very expansive, being all facilities or capital projects financed in whole or in part with the proceeds of a single issue of bonds, regardless of the properties’ locations or placed-in-service dates. However, any facilities or capital projects financed with a later issue are a separate project, even where separate series finance the construction of a single building.

Significantly, no specific declaration or recordation is required to take advantage of floating equity. However, in order for equity to be qualified, it must be contributed as part of the “same plan of finance” as the tax-exempt bonds and cannot be expended prior to the earliest date for which tax-exempt bond proceeds may be allocated to the project (60 days prior to the date of issuance unless an appropriate reimbursement resolution is in place). In addition, the qualified equity must be paid before the placed-in-service date of the project.

As shown below, this method distinguishes between that which might be private business use (here called “Potential Private Business Use”) and that private business use that will count against an issue and that is to be tracked and reportable, where necessary (here called “Actual Private Business Use”).

C. Practical Implications

For new projects financed in part with tax-exempt bonds and in part with qualified equity, the New Regulations should provide a great deal of flexibility.

- It is now even more important to make an ongoing practice of adopting reimbursement resolutions. Expenditures made more than 60 days prior to the adoption of a reimbursement resolution will have to be financed with qualified equity, but that qualified equity will not be able to “float” around the project in the same way as qualified equity accompanied by a reimbursement resolution.

- For issuers and borrowers that have not previously utilized the floating equity methodology for reporting and tracking private use, internal tracking and compliance systems may need to be modified.

- Refundings of bonds that did not previously use the floating equity methodology may present particular challenges. Historical records as to the amount of qualified equity used to fund a particular project may not be available. Where borrowers excluded particular space from the scope of projects financed with tax-exempt bond proceeds, they may have focused solely on that space when considering private business use. To take advantage of the floating equity methodology, private business use must be considered throughout the entire project.

- Financings that span more than one issue of tax-exempt bonds will need to be carefully planned from the outset. The New Regulations’ restrictions on the timing for allocating qualified equity to a series of tax-exempt bonds may impact when qualified equity is most appropriately spent on a project.

- Funds used to pay off tax-exempt bonds, such as in remedial actions, do not count as qualified equity. Therefore issuers and borrowers must continue to separately track remediated space and assets, as that space cannot “float.”

- As a practical matter, allocations of qualified equity and tax-exempt bond proceeds should be recorded in a final allocation, which must be made by the soonest of 18 months after the expenditure is paid, 18 months after the project is placed in service, 5 years and 60 days after the bonds are issued or 60 days after the bonds are retired. Of note, because equity must be paid by the placed-in-service date of the project, the deadline for inclusion of qualified equity in a mixed-use project will frequently pass before the deadline for making a final allocation of bond proceeds to projects.

II. Public-Private Partnerships

A. Prior Rules

Since 2006, proposed Treasury Regulations have provided that in the case of a partnership in which each of the partners is a governmental person (or in the case of 501(c)(3) bonds, a governmental person or a 501(c)(3) entity), the partnership is disregarded as a separate entity and is treated as an aggregate of its partners, but that otherwise (i.e., where one or more partners is a for-profit entity), the partnership is treated as a separate entity that is a non-governmental person. As a practical matter, this has meant that where any interests in a partnership are held by for-profit entities, the entire partnership has been treated as a private user, no different from a for-profit corporation.

B. Changes

The New Regulations take the opposite approach. Partnerships that include both for-profit participants and governmental persons (which, in the case of 501(c)(3) bonds, includes 501(c)(3) organizations) will be treated as an aggregate of the partners. As a result, private business use of partnerships will now be measured in proportion to the partnership interests owned by for-profit partners. For example, if a 501(c)(3) organization and a for-profit entity formed a 50/50 partnership and the partnership then leased tax-exempt bond-financed space, under the New Regulations, the resulting private use would be 50 percent of the space/proceeds in question.

The amount of private use is determined using the for-profit party’s greatest percentage share of any partnership item of income, gain, loss, deduction or credit attributable to the period that the partnership uses the property.

The New Regulations also apply to private ownership (the amount of private ownership is limited to the maximum for-profit partnership share of any item), but given that for 501(c)(3) bonds the absolute prohibition on private ownership of bond-financed assets remains, this relaxing of the private ownership restrictions is likely only useful in combination with allocations of qualified equity, as discussed above.

C. Practical Implications

As with the New Regulations regarding qualified equity, the new standard for public-private partnerships should give issuers and borrowers additional flexibility in financing assets, avoiding private business use and ensuring ongoing compliance with tax-exempt bond restrictions. In order to take advantage of this flexibility, it may be necessary to undertake additional recordkeeping and diligence, especially to determine the maximum amount of income, gain, loss, deduction, credit, etc. for any public-private partnerships using bond-financed assets.

III. Anticipatory Remedial Action

A. Prior Rules

Treas. Reg. 1.141-12 provides ways for an issuer or borrower to take curative action if its bonds violate the restrictions on private business use or ownership, provided action is taken in a timely manner after the violation (often 90 days). Because the language of this section refers only to an “action that causes an issue to meet the private business tests” (emphasis added), there has been some dispute as to whether or not a remedial action could be taken prior to the action that triggers the violation.

B. Changes

The New Regulations add a new section to Treas. Reg. 1.141-12, which explicitly allows for anticipatory remedial action. In order to take remedial action prior to the event that would violate the restrictions on private use, a borrower or issuer must make a declaration of official intent on or prior to the date of redemption or defeasance of the affected bonds, identifying the financed asset(s) to be de-financed and the expected deliberate action that would give rise to private business use of such asset(s). In order to take anticipatory remedial action, a borrower or issuer must have a reasonable expectation that the expected deliberate action will come to pass.

C. Practical Implications

For borrowers and issuers whose counsel was already comfortable with anticipatory remediation, the New Regulations confirm this approach and may only result in some minor changes to the documentation executed at the time of an anticipatory remediation. For others, this guidance will allow a greater time frame during which remedial action may be taken and will presumably provide greater operational flexibility.

___________________

With last year’s creation of a new, more flexible five-year safe harbor under Rev. Proc. 97-13 and now with the New Regulations, the IRS is clearly trying to update the rules surrounding the use of facilities financed with tax-exempt bond proceeds to accommodate current business practices with stated focus on health care. Hall Render is proud to have been part of special committees of the National Association of Bond Lawyers that requested both the updates to Rev. Proc. 97-13 and the aggregate treatment of public-private partnerships, as well as having been part of the industry-wide call for adoption of final allocation and accounting regulations. We believe that these changes will give our clients more options at the time of issuance of tax-exempt bonds and greater operational flexibility throughout the life of the bonds. We are encouraged that the IRS has proved so responsive.

For any questions about the New Regulations or private business use of facilities financed with tax-exempt bonds, please contact:

- Your regular Hall Render attorney.

Please visit the Hall Render Blog or click here to sign up to receive Hall Render alerts on topics related to health care law.

1 Certain taxable debt that is otherwise tax-advantaged, such as Build America Bonds or other tax credit bonds, is also subject to the restrictions on private use.

2 For governmental bonds, only state or local governmental entities are qualified users. For 501(c)(3) bonds, qualified users include both state and local governments AND 501(c)(3) organizations engaged in activities that do not constitute an unrelated trade or business.

3 The final allocation deadline is the later of 18 months after the expenditure is paid or 18 months after the project is placed in service, but in any event by 5 years and 60 days after the bonds are issued or 60 days after the bonds are retired.